The Importance of Financial Advice in Divorce

Divorcing is just hard – and it usually comes down to kids and money. On top of worrying about your family, one of the biggest concerns people have is wondering if you will be okay financially after divorce.

Many couples who are facing divorce have the following pressing questions:

- Will we have to sell the house, or can one of us keep it?Â

- Will I qualify for a mortgage on my own?

- Do we have to stop kid’s activities?Â

- Will I have to go back to work?

- Will I need to push out my retirement date?

- How much worse off will I be after divorce?

When a decision is made to get a divorce, most people want to get to a settlement that works for them. From my experience, what is often missing is financial advice and financial expertise.

Fear of an uncertain future often makes divorce more difficult than it has to be. Divorcing clients fear his or her future, while legal discussions deal with what is “now.†And when two households now have to live on the same income that previously supported only one household, the importance of divorce financial planning becomes obvious.

There are common financial mistakes make when facing divorce.Of course it depends on each situation, but what I can tell you is that if you get divorce financial advice before you sign off on your separation agreement, you stand a much better chance of getting through your divorce arriving at a settlement that works for all.

In this post, I will be providing an explanation of why financial advice in divorce is important, how it differs from legal advice and what the role of a divorce financial expert actually is.

So what is a divorce financial expert?

When people think about divorcing, they first think of hiring a lawyer. Typically getting financial advice comes once you have an agreement and are looking for help in investing money resulting from the divorce.Â

Traditional financial advisors, have had little or no training specifically related to the financial issues that surround divorce. This is why if you are contemplating divorce, you need to find someone who has the training and expertise around divorce specific financial issues.

AÂ divorce financial expert is a Certified Divorce Financial Analyst (CDFA) or a Chartered Financial Divorce Specialist(CFDS). They have a financial planning /accounting background and have training to analyze and provide expertise relating to the financial issues of divorce.Â

A divorce financial expert can help you at the beginning of your divorce, at the end, and everything in between. They can work in conjunction with your lawyer to solidify an even stronger team to support you. They are engaged to provide initial guidance on the divorce process, to assist you in pulling together your financial “facts”, and getting you organized for the process ahead.Â

The divorce financial expert’s role is to:

- organize, gather, and analyze all pertinent financial information.

- understand your historical lifestyle as a married couple

- interpret changes in lifestyle during the divorce, and project your needs on a post-divorce basis.

- bring together all of the tangible and intangible benefits (such as retirement, deferred compensation, perquisites) to accurately portray what value they are to you now, and upon disability, termination, retirement, or death.

- educate in a way that leads to confident resolution of financial issues.

They use specialized software to calculate the long-term effect of child support, spousal support and property settlement scenarios along with post divorce budgets.

They provide expert financial analysis and strategy but take care to tailor it within the legal environment.

While divorce financial experts cannot give legal advice, they can certainly educate and empower you to make the right decisions for both you and your family, during a time that can be extremely emotional and exhausting. A divorce financial expert can give you the information, guidance and tools you need to make these decisions, especially if you have not been involved in your family’s financial situation until now. Involving a financial divorce expert in your divorce negotiations can help ensure that both spouses are fairly treated.

It is often beneficial for a divorcing couple to hire a divorce financial expert together, because they are trained to be settlement focused – and achieve the best results for both spouses. If one person has more access to the couple’s financial information, it makes sense to work together on the financial disclosure. Eventually everyone will have to disclose, so why not do it together to save time and money? A divorce financial expert will also put the “unfinancial” spouse on the same level as the person who manages the finances of the family. Think about this, as decisions made uninformed and emotionally can often be incorrect and have a significant future impact on a family.Â

When couples separate, there is the “business†part of their relationship you must deal with, that is the “money†part. Divorce, you must realize, is not only the breakup of an a family unit, it’s the breakup of an economic unit as well .

Most couples do not have a clear idea of what an equitable divorce is. What’s fair and equal today may not be so in the future. You need to quantify what fair means over time taking growth rates, inflation and taxes into account. Knowing what you’re going to end up with is meaningless unless you know what you need.

It’s surprising in this day and age that many spouses when faced with divorce, are not aware of their family finances and are not aware of details of investments, pensions, survivor benefits, company benefit plans, insurance policies, business interests. Are credit cards in their own name? Have they built individual credit histories and ratings?Â

Couples need to understand the financial implications of all the options available to them and make decisions from an informed position, as these decisions will affect the rest of their lives.

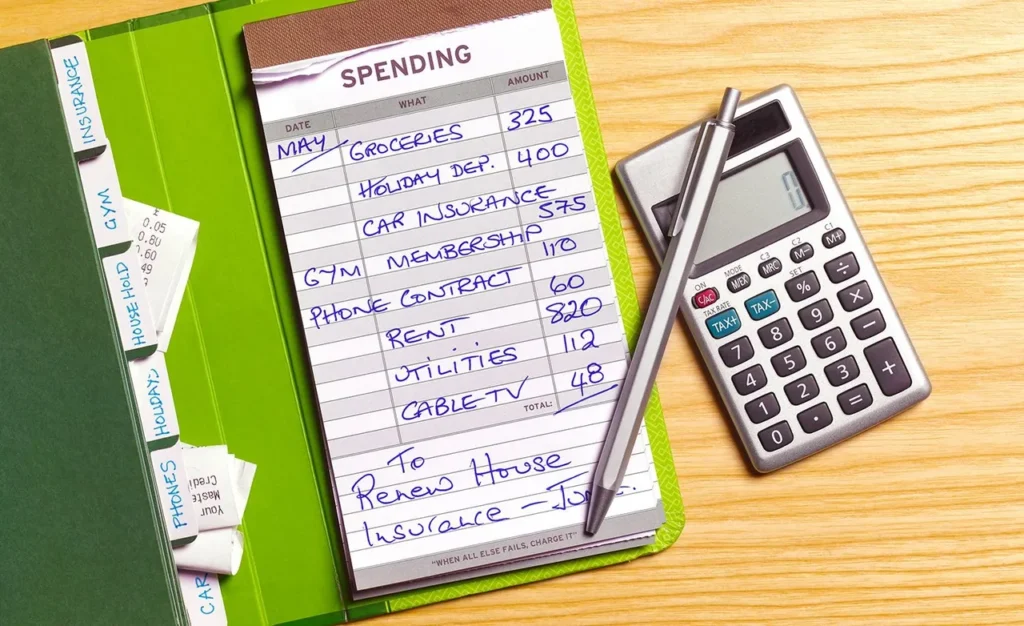

When contemplating separation, couples need to take a hard look at their lives, what they do and quantify how much their lifestyle truly costs. You earn what you earn, and unless there is another source of funds to draw on, you live on what you take home in your paychecks, making ends meet as best you can. Or you regularly live beyond your means. If this is what you do when married, it will not likely change when you are separated.Â

However, easy access to credit means that people not only spend money they have, but they spend money they haven’t actually earned yet. The notion of distinquishing between needs and wants is something you may have difficulties with when married. This notion of “wants†and “entitlement†enables a couple to live beyond their means. Because of that, you may head into your newly single life with unrealistic expectations.

Traditional financial planning is based on a couples combined assets and combined incomes. Looking at a couple as a “financial unitâ€, the whole is greater than the sum of its parts. In a recent U.S. study of the financial and marital status of more than 9,000 men and women, it was found that on average, by their mid-40’s, married individuals achieve 75% more wealth per person than singles do.

I ask separating couples when they first start working with me, to take a hard look at their lives and quantify how much their lifestyle truly costs. Some, not all, expenses will be doubled once you are on your own.. The expenses with respect to housing, usually your largest expense, will usually increase, if only for a period of time. My experience shows that many couples do not track their spending or follow budgets they may set up once a year. I recommend and help couples work on creating a historic summary “lifestyle analysisâ€Â based on their spending and expenses pre-separation. The historic “lifestyle analysis†becomes a concrete baseline which each spouse can use to better estimate what their individual future budget spending might be and whether they can sustain their lifestyle going forward. In addition, there may be some “joint spending†on such things as children’s weddings that should be accounted for. Some, not all expenses will be doubled. There may be two mortgages /rental payments, higher car insurance rates and cell phone plans (when you unbundle family plans). Health care coverage may end for one spouse and have to be funded out of pocket. All of these things need to be taken into account. If things were tight before, it’s going to be tight after separating.

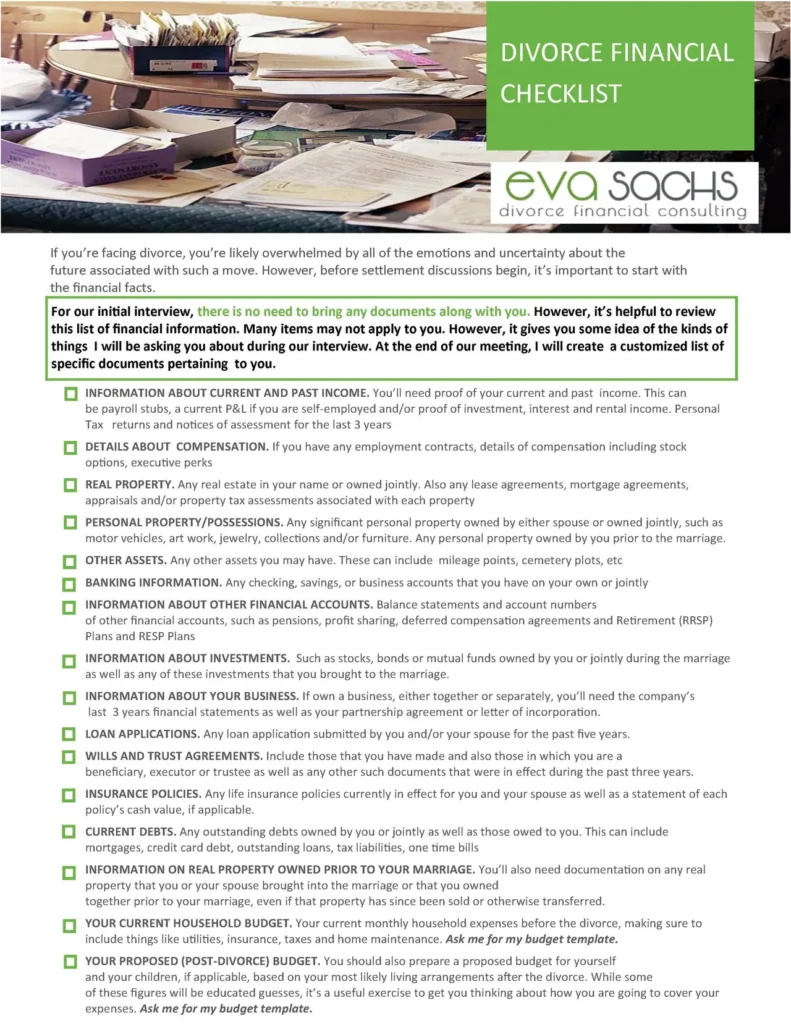

Financial Disclosure is the process of gathering financial facts. Some information, like bank, investment statements, may be easy to gather. Other things, such as real estate, business, pension valuations may take more time as other professionals may be required to provide this information.

The most expensive delays in the entire divorce process come from delays in financial disclosure. Divorce costs are high because people are disorganized, unsure of their finances. I put everything together for you in a timely and cost-efficient manner. I provide tips on how to begin to collect and organize your financial information, and on how to create a current budget and future spending plan.

I believe in building a good decision making process. As part of your negotiation discussions, you need help to find the most viable and practical solutions. I create settlement projections scenarios that show how the combination of income, property division and support payments come together with post divorce budgets to show how it may be possible for each spouse to reach their preferred lifestyle. In many situations, couples realize that they may agree on more issues than they disagree. I identify some of the gaps and guide you to settlement without hurting the respect and care you may still have for one another.Â

Think of me as your financial personal trainer. Pretend you want to lose 100 pounds. Logically, you know that you must exercise and eat better and that will get you the results you need. But is this enough? You know you’ll achieve better and more long-term results if you work with a trainer who has the knowledge and expertise to explain the different diet and lifestyle options to you – many of which you may not have even been aware of. What if you had someone to map out the right exercise program just for you? What if you had someone to be on your side, explain the process, work with your other professionals you have hired, and hold you accountable, so that you meet your desired results in the best way possible? Think of me as your personal financial trainer and support system.Â

Working with a divorce financial expert like me, you will understand the financial implications of your divorce settlement. You’ll be in the position to make the most informed decision about your and your family’s future.

You don’t want to make a decision without the right information.Contact me to see how I can help envision your future after divorce before you divorce.